Travelling Allowance Daily Allowance (TA DA) Rules 2017

If Government employee travels for ”Official Purpose” than he is entitled for Travelling cost compensatory allowance.

Medical officer can use AutoRikshaw/Taxi to reach Bus Stand/ Railway Station and after than he can travel in “3rd AC Train” and in Any “AC Bus” !!

while travelling for official purpose he will also get “Daily Allowance” for Food and other things, IF he stays at Hotel than entitled for Boarding and Lodging Allowance.

TA – XX% Dearness Allowance (DA) is applicable on TA (TA+XX% of TA)

* Exempted in Income Tax

* Generally not given monthly

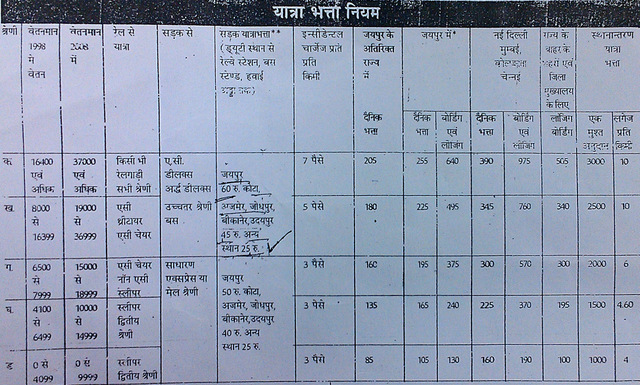

Categories Class of Government servants based on ‘Basic Pay’

i.e. total of pay in Running Pay Band and Grade Pay – (according to 6th pay commission)

Category ‘A’ Government servants drawing basic pay of Rs. 37000/-— per month or above

Category ‘B’ Government servants drawing basic pay of Rs.19,000/- or above but below Rs. 37,000/- per month.

Category ‘C’ Government servants drawing basic pay of Rs.15, 000/- or above but below Rs. 19,000/- per month.

Category ‘D’ Government servants drawing basic pay of Rs.10, 000/- or above but below Rs. 15,000/- per month.

Category ‘E’ Government servants drawing basic pay below Rs.10,000/- per month.]

Medical Officer is Category ‘B’ Government servant because he is drawing basic pay of Rs 21,000/- per month and above.

TA Rules for Category ‘B’ Government servant –

Allowed 3rd AC Train, may travel in 2nd AC if 3rd AC not available in train (reservation charges included)

Journey by own car – 9.0/- per km subject to maximum of Rs. 600/- per month.

Mileage Allowance for journey to reach Airport/Railway station/Bus Stand from duty point/Residence and vice versa (when coming Back) –

| Place | Rate |

| Jaipur | Rs. 150/- |

| Jodhpur, Udaipur, kota, Bikaner and Ajmer | Rs. 100/- |

| All state capitals in india (except Jaipur) including Delhi | Actual charges paid in payment of fare for Taxi, Auto Rickshaw, Tonga, Bus, Rail, Metro etc. |

| Other Places | Rs. 60/- |

DAILY ALLOWANCE (DA) –

DA Rules for Category ‘B’ Government servant – When the Government servant DO NOT stays in a hotel.

For All State Capitals including Jaipur and cities, viz Nagpur, Kanpur, Allahabad, Pune and Ahmadabad – 700/- (Amount in Rs)

For Cities District headquarters except capitals those mentioned above – 500/- (Amount in Rs)

DAILY ALLOWANCE (DA) FOR BOARDING AND LODGING –

DA Rules for Category ‘B’ Government servant – When the Government servant stays in a hotel or other establishment providing Boarding and/or Lodging on tour at fixed rate provided that such hotel/ institution is registered /has obtained- license from the Competent Authority viz. Nagar Nigam, Sales Tax Authority, GST Authority, Service Tax Authority etc.

For All State Capitals including Jaipur and cities, viz Nagpur, Kanpur, Allahabad, Pune and Ahmadabad – 2500/- (Amount in Rs)

For Cities District headquarters except capitals those mentioned above – 1800/- (Amount in Rs)