Privileged Leave – Earned Leave – उपार्जित अवकाश

सरकारी कर्मचारी को एक वर्ष में कुल 30 उपार्जित अवकाश देय होते हैं |

ये अवकाश दो किश्तों में मिलते हैं – 1 जनवरी को 15 PL, 1 जुलाई को 15 PL, कुल तीस |

इनका इन्द्राज कर्मचारी की सर्विस बुक में होता है एवं ये वर्ष उपरांत बचे रहते हैं और जुड़ते रहते हैं, अधिकतम 300 PL जुड़ सकती हैं, उसके बाद स्वतः खत्म होती रहती हैं | कर्मचारी इन अवकाशों का उपभोग कर सकता है जिसके लिए उसे अवकाश तिथि से 21 दिन पहले संलग्न PL Form में अपने उच्चाधिकारी से अनुमति लेनी होती है |

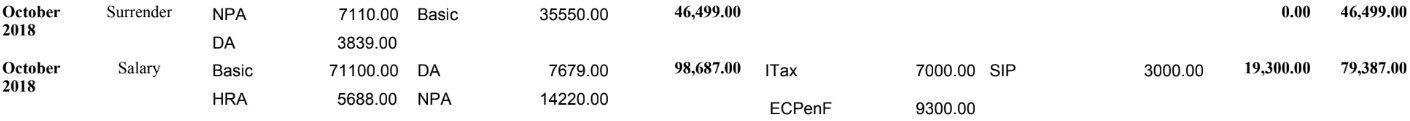

कर्मचारी चाहे को साल कि कुल तीस PL में से 15 PL को Leave Encashment Scheme के तहत अप्रेल से मार्च तक के फाइनेंसियल इयर में संलग्न PL Form भरके, ये लीव सरेंडर करके इनका नकद पैसा लिया जा सकता है, सरेंडर के बदले में मिलने वाला पैसा = (15 Days Basic Pay + 15 Days NPA) * DA | चूँकि हर वर्ष जुलाई में वार्षिक वेतन वृद्धि हो जाती है एवं DA (Dearness Allowance) भी बढ़ जाता है, अतः जुलाई के बाद लीव सरेंडर करने पर ज्यादा पैसा मिलता है |

300 जमा हो चुकी PL का पूर्ण नकद पैसा रिटायर्मेंट के समय लिया जा सकता है, जिस पर किसी भी प्रकार का कोई टेक्स नहीं लगता है लेकिन सेवा के दौरान सरेंडर की गयी PL पर मिलने वाला पैसा पूर्ण रूप से TAXABLE है |

Earned Leave (EL)

- The EL admissible to a member of the staff shall be 30 days in a calendar year. 15 days of EL is credited in advance on the first January and first July every year.

- The credit will be reduced by 1/10th of EOL and or period of dies non during the previous half-year, subject to a maximum of 15 days.

iii. The advance credit for the half-year in which a staff is appointed will be at the rate of 2½ days for each completed calendar month of service.

- EL credit for the half-year in which the staff retires/resigns/removed/dismissed or dies in service will be afforded at the rate of 2½ days per completed calendar month up to the end of the calendar month preceding the last calendar month of service. While affording credit, fraction shall be rounded off to the nearest day.

- EL can be accumulated up to 300 days (including the number of days for which encashment has been allowed along with LTC)

vi When the credit of EL at the start of any half year, results in the total accumulation of EL being more than 300 days, the 15 days EL for that half year shall be kept separately and set off against the leave availed during that half year. Any portion of this separately credited leave not availed within the half year, shall be accumulated with the previous EL to the credit of EL account, provided the total accumulated EL does not exceed 300 days. Such procedure may be restored to in cases where the earned leave at the credit of the Institute employee on the last day of December or June is 300 days or less but more than 285 days.

vii. The maximum amount of Earned Leave that can be granted to a member of the staff at a time shall be 180 days.

viii. EL may be taken at a time up to 300 days as leave preparatory to retirement.

ix EL upto 300 days at a time may be granted to Group A and B Officers, if at least the quantum of leave in excess of 180 days is spent outside India, Bangladesh, Nepal, Bhutan, Burma, Sri Lanka and Pakistan.

x Encashment of EL while availing LTC upto 10 days on each occasion and a maximum of 60 days in the entire service are permissible. At least equal number of days of EL should be availed of along with encashment. The encashment so availed will be taken into account while computing the maximum admissible for encashment at the time of quitting service.

- For leave encashment HRA, CCA and special increment for small family norms are not taken into account.

Guidelines for carrying over the Earlier Leave Accounts

- The EL account of a staff member as on 31.12.2003 shall be carried forward and credited to his/her EL account in the Institute subject to the prescribed limit of accumulation of leave. The maximum limit at that time was 240 days for EL. Then an advance credit of 15 days on 1st January and 15 days on 1st July will be made. If a staff member is having 133 days EL at credit as on 31.12.2003 and if he/she has not availed of any EL or vacation during the period 1.1.2004 to 30.6.2004, then on 1.7.2004 his/her EL account will have 133 + 15 + 15 = 163 days at credit.

- There is no provision for unearned leave on medical certificate, usually called medical leave in Government of India. Only HPL/Commuted Leave is available which can be availed of on medical grounds.Since the HPL is calculated at the rate of 20 days for each completed year of service and credited in advance at the rate of 10 days on 1st January and 10 days on 1st July, HPL in credit of an employee is calculated as follows: If the number of years of service put in by the employee is ‘n’ as on 31.12.2003 and the number of days of Medical leave availed up to 31.12.2003 is ‘m’, then, the number of days of half pay leave at the credit on 31.12.2003 is ‘20n -2m’ . If this number becomes negative, it is made as zero. From 1.1.2004, onwards, the half pay leave is credited at the rate of 10 days on 1st January and 1st July every year.

Illustration: 1

If an employee has put in a service of 8 years and 7 months on 31.12.2003, and he/she has availed Medical Leave for 34 days upto 31.12.2003, then the number of days of HPL at credit as on 31.12.2003 is 160 + 12 – 68 = 104. On 1.1.2004 HPL at credit is 114

For 8 years : 160 days of HPL plus for 7 Months : 12 days of HPL [(7/12) x 20 = 12] (rounded off to the nearest integer) minus for Medical Leave of 34 days : 68 days of HPL = 104 days of HPL

Illustration: 2

If an employee has put in a service of 34 years and 1 month on 31.12.2003, and he/she has availed Medical Leave for 427 days upto 31.12.2003, then the number of days of HPL at credit as on 31.12.2003 is zero (since 682 – 854 is negative)

iii. The EL accumulation at the Institute, including the leave accumulated prior to 1.1.2004 (under State Government service), shall be eligible for encashment at the time of retirement subject to limits prescribed in these rules. The leave encashment availed prior to 1.1.2004 shall not be taken into account for the purpose of the ceiling of number of days for which encashment is admissible at the time of retirement from this Institute. For example, if a staff has encashed 40 days of EL before 1.1.2004, and if he/she has accumulated 300 days EL as on the date of his/her retirement on or after 1.1.2004, he/she will be entitled to encashment of 300 days of EL at the time of his/her retirement from the Institute, provided no encashment of EL has been done for the purpose of LTC on or after 1.1.2004.

- As on date, the maximum limit for accumulation of EL is 300 days and there is no limit for accumulation of HPL.

⇓ Share this post on Whatsapp & Facebook ⇓